Protecting Your Business: How to Spot Fake Pay Stubs

Introduction

As a business owner or employer, it is crucial to protect your business from potential fraud and deceit. One area where fraudulent activities can occur is through fake pay stubs. Fake pay stubs can how to pass snappt verification be used by individuals to deceive landlords, lenders, and even government agencies. In this article, we will explore the various ways you can spot fake pay stubs and protect your business from financial losses.

How to Make Check Stubs: A Closer Look

Understanding the Basics of Pay Stubs

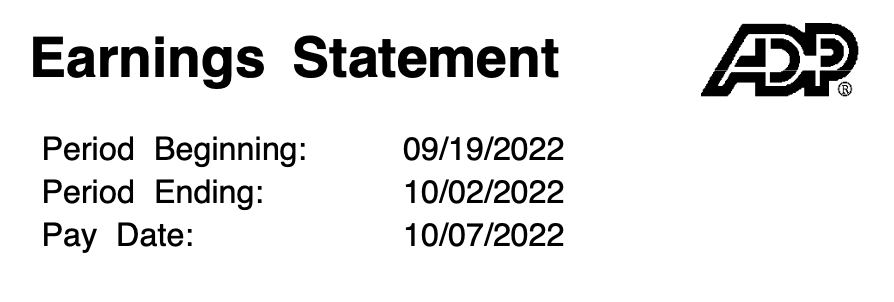

Before we dive into spotting fake pay stubs, let's first understand the basics of what a legitimate pay stub should look like. A pay stub is a document that outlines an employee's earnings and deductions for a specific period. It typically includes details such as gross wages, taxes withheld, deductions for benefits, and net pay.

Using Paystub Generators: A Double-Edged Sword

With the rise of technology, it has become increasingly easy for individuals to create their own pay stubs using online generators. While these tools can be useful for small businesses or self-employed individuals, they have also given rise to the creation of fake pay stubs.

Common Signs of Fake Pay Stubs

Now that we have a basic understanding of pay stubs and how they can be easily created, let's explore some common signs that may indicate a pay stub is fake:

Inconsistent Formatting: Legitimate pay stubs often have consistent formatting, including font styles, sizes, and alignment. Fake pay stubs may display inconsistencies in these areas.

Suspiciously High Earnings: If the earnings listed on a pay stub seem unusually high compared to industry standards or the employee's position, it could be a red flag.

Missing or Incorrect Information: Legitimate pay stubs should include essential information such as the employee's name, social security number, employer details, and accurate earning and deduction amounts. Fake pay stubs may have missing or incorrect information.

Unusual Deductions: Pay stubs typically show deductions for taxes, benefits, and other authorized withholdings. If you notice unusual or unauthorized deductions on a pay stub, it could be a sign of fraud.

Lack of Company Logo or Branding: Legitimate pay stubs often include the company's logo or branding elements. If a pay stub lacks these visual cues, it may indicate a fake document.

Poor Quality Printing: Pay stubs that appear blurry, smudged, or poorly printed may be indicative of a fake document.

How to Make Fake Pay Stubs: Uncovering the Techniques

While we aim to educate business owners on spotting fake pay stubs, it is also essential to understand how individuals create these fraudulent documents. Home page Here are some common techniques used to make fake pay stubs:

Photoshop Editing: Skilled individuals may use photo editing software like Photoshop to alter legitimate pay stub templates or create entirely new ones.

Online Pay Stub Generators: As mentioned earlier, online pay stub generators can be used not only for legitimate purposes but also for creating fake pay stubs.

Using Fake Companies: Some individuals may create fictitious companies and generate pay stubs that appear legitimate at first glance.

Obtaining Real Pay Stubs: Fraudsters may go as far as obtaining real pay stubs from employees of legitimate companies and altering the information to suit their needs.

Protecting Your Business: Steps to Take

Now that we have discussed the various signs of fake pay stubs and the methods used to create them, let's explore some steps you can take to protect your business:

Conduct Thorough Background Checks: When hiring new employees, conduct comprehensive background checks to verify their employment history and credentials.

Cross-Reference Information: Verify the information provided on pay stubs with other documents, such as employment contracts or tax forms, to ensure consistency.

Implement Payroll Software: Invest in reliable payroll software that generates and stores digital copies of pay stubs. This can help detect any inconsistencies or alterations made to documents.

Train Employees and Managers: Educate your employees and managers on how to spot fake pay stubs and the potential consequences of accepting fraudulent documents.

Establish Clear Policies: Develop clear policies regarding pay stub submission, verification processes, and consequences for submitting fake documents. Communicate these policies to all employees and enforce them consistently.

Consult with Experts: When in doubt, consult with experts such as forensic accountants or legal professionals who specialize in fraud detection to ensure your business is adequately protected.

FAQs

Q: How can I make legitimate check stubs for my employees? A: To create legitimate check stubs, use reliable payroll software that generates accurate and compliant pay stubs based on the employee's earnings and deductions.

Q: Are online pay stub generators illegal? A: No, online pay stub generators themselves are not illegal. However, they can be misused to create fake pay stubs, which is illegal.

Q: What should I do if I suspect an employee has submitted a fake pay stub? A: Gather evidence and consult with legal professionals to determine the appropriate course of action. This may involve termination of employment or legal proceedings.

Q: Can landlords spot fake pay stubs easily? A: With proper knowledge and attention to detail, landlords can spot fake pay stubs by looking for common signs of fraud.

Q: How can businesses prevent employees from creating fake bank statements? A: Businesses can implement strict verification processes when requesting bank statements from employees and cross-reference the information with other documents to ensure authenticity.

Q: Is it illegal to create fake pay stubs for personal use? A: Creating fake pay stubs for personal use can be considered fraud and may have legal consequences. It is important to always use legitimate documents for any financial transactions or applications.

Conclusion

Protecting your business from fraudulent activities, such as fake pay stubs, is crucial for maintaining its financial stability and reputation. By familiarizing yourself with the signs of fake pay stubs, understanding the techniques used to create them, and implementing proper verification processes, you can safeguard your business from potential losses. Stay vigilant, educate your employees, and seek expert advice when necessary to ensure the integrity of your business transactions.